Just when we are all getting used to Auto enrolment, further changes are afoot with Minimum Pension Contributions set to increase from April 2018.

Under the Pensions Act 2008, the minimum amounts a company and their staff pay into the automatic enrolment pension scheme will increase as planned. Here’s what you as an employer need to do.

Does it apply to you?

If you have put your staff into a pension scheme for automatic enrolment you will need to make sure that at least the required minimum amount is paid by you and your staff into the scheme. If you don’t have any staff in an automatic enrolment pension scheme then you do not need to take further action to implement these increases.

When do you need to make the increases?

You must increase the minimum contributions from 6 April 2018 and then again from 6 April 2019. All employers must take action to make sure at least the minimum amounts are being paid into their automatic enrolment pension schemes.

What are the increases?

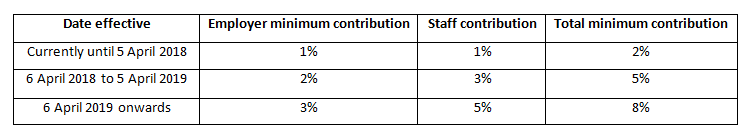

The table below shows the minimum contributions that most employers pay and the dates when they must increase:

You may have agreed with your pension provider to calculate minimum contributions in a different way. If this is the case you will need to apply different increases. To find out what these increases are go to: www.tpr.gov.uk/certified

What do you need to do?

From 6 April 2018, the way you calculate and pay contributions into your pension scheme must have been changed to reflect these increases. Your pension provider, and if you use one, your payroll software or payroll provider, may be in touch about these changes before they come into effect. You should also let your staff know about any increases being applied to their contributions.

If you are already paying above the increased minimum amounts, you do not need to take any further action.

For more information go to: www.tpr.gov.uk/increase

What if you don’t have any staff in a pension scheme?

You still need to assess anyone who works for you each time you pay them and put them into a pension scheme if they meet the criteria for automatic enrolment. For more information go to www.tpr.gov.uk/ongoing

It is your responsibility to make sure the right minimum contributions are being paid for your staff. Make sure you have plans in place to comply with the law.