When do the new furlough scheme rules come into place?

From 1 May 2021 and ongoing.

Will the changes affect me?

If you are an employee who is being paid 80% of your usual pay for the time you are furloughed, then no, you shouldn’t see any change to what you receive in pay when on furlough.

If however, your generous employer has been paying you 100% of your usual wage while on furlough, you may see this fall to no less than 80% of regular wages as your employer now has to contribute more to that amount.

If however, you are an employer, then you need to be aware of the upcoming changes as the level of the furlough grant paid by the Government is reduced, and you are asked to contribute towards the cost of your furloughed employees’ wages.

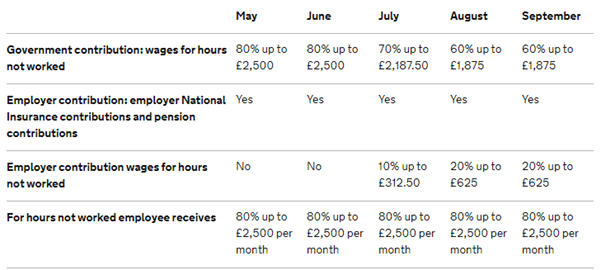

This is laid out in the table below.

What are the main changes?

Changes to employer contribution

Employers will now be required to contribute to their furloughed employees’ National Insurance and Pension costs.

From 1 July 2021, employers will also be required to pay 10% of their furloughed employees wages (up to £312.50).

From 1 August 2021, the required wage contribution will rise to 20% of furloughed employees wages (up to £625).

Changes to the government grant

From 1 July 2021, the government will only pay 70% of furloughed employees wages.

From 1 August 2021, the government furlough contribution will lower even further, to 60%.

Changes to claims for variable pay

From 1 May 2021, when calculating the average wages for employees not on a fixed salary, you should no longer include periods of:

- Statutory sick pay

- Family related statutory leave

- Reduced rate paid leave following a period of Statutory Sick Pay or family related leave

However, if your employee went on one of these types of leave for the entire month claimed, then you should continue to include the days and wages related to that date.

Who is still eligible for the furlough grant?

Employer eligibility

To be eligible for the grant, you must continue to pay a minimum of 80% of your furloughed employees wages, up to a cap of £2,500 per month.

Employee eligibility

Previously ineligible employees (those that were not on your payroll on 30 October 2020) may be eligible from 1 May 2021 onwards.

From May, you will be able to claim for employees who were on your PAYE payroll on 2 March 2021.

Although, you must have also made an accompanying PAYE Real Time Information (RTI) submission between 20 March 2020 and 2 March 2021 to notify HMRC of that employee’s earnings.

You do not need to have been a previous claimant to be eligible for the grant.

Can I claim a furlough grant to pay for holiday leave?

You can claim for periods of paid leave taken by furloughed employees, including for bank holidays.

If your employee is furloughed for only some of their hours, you can count time taken as holiday as furloughed hours, rather than working hours.

If a furloughed employee takes holiday, you should make sure you are calculating the correct holiday pay, and not simply continuing to pay the 80% you receive through the furlough scheme. You may need to top up your employees’ pay to 100% of their normal salary.

What about wage caps?

The wage caps (see table above) change in line with the hours not worked by furloughed employees.

The maximum amount a fully furloughed employee can receive each month is £2,500.

You can choose to top up employee wages above the £2,500 cap, but, this is at your own expense.

When does the scheme end?

The Furlough Scheme ends on 30 September 2021.

What happens when the furlough scheme ends?

You must decide to either:

- Bring your employees back to work on their normal hours

- Reduce your employees’ hours

- Terminate their employment

When are the furlough claim deadlines?

What happens if I miss a deadline?

From 1 November, HMRC have agreed to take a lenient view on late claims, but you must still have a reasonable excuse for missing the deadline.

What happens if I didn’t claim enough/overclaimed?

Underclaims

You can increase the amount of your claim, but only if you amend the claim within 28 calendar days of the month of the respective claim.

Overclaims

If you’ve overclaimed, you have two options. You can either:

- Correct it in your next claim (your new claim will be reduced)

or…

- Get a payment reference number and pay HMRC back within 30 days (only if you’re not correcting it in your next claim)

If you’ve overclaimed a grant and not repaid it, you must notify HMRC within 90 days after the date you received the grant. If you fail to do so, you may have to pay a penalty decided by HMRC.

What else do I need to know?

- You must keep a copy of all furlough claim records for at least 6 years.

- You must include furlough scheme payments as income when you calculate your taxable profits for Income Tax and Corporation Tax (deduct employment costs as usual).

- Employees that are not employed as part of a business (such as nannies or domestic staff) are not taxable on grants received under the furlough scheme.

Additional Resources

Check if you can claim for your employees’ wages through the Coronavirus Job Retention Scheme – GOV.UK

Coronavirus Job Retention Scheme – A step by step guide for employers – GOV.UK

COVID-19 Helpline for businesses and self-employed – GOV.UK

Changes to the Coronavirus Job Retention Scheme from July 2021 – GOV.UK

Holiday entitlement and pay during COVID-19 – GOV.UK

Pay Coronavirus Job Retention Scheme grants back – GOV.UK

Still unsure of something?

Please contact us here if you have have any queries or need some friendly advice – we’d be more than happy to help. Alternatively, come and visit us in Hazel Grove for no obligation coffee!