Marriage Allowance – What’s it worth??

Hands up if you have heard talk of Marriage Allowance? 🙋🏽♀️ Not exactly a reason to say ‘I do’ but definitely a little gem of

IN Accountancy offers a full accountancy service to individuals.

Many of our clients want a team to deal with their personal tax affairs correctly, on time and without fuss. That’s where we come in, giving you the services you need, not the extras you don’t. So you can relax knowing your tax accountant is freeing you from the hassle of sorting out your tax return.

Claiming tax can be a tricky business. First, you need to know what you can claim. Next, you need to calculate what’s due and complete all the forms. We’ll take care of it.

From gift aid and child tax credits to business mileage and pension contributions, you could be entitled to many different tax refunds. Just send in your paperwork and we’ll look into it.

You can trust us to handle your tax in an experienced, legal manner – we’ll keep things as simple and straightforward as possible while also helping you claim what you’re entitled to.

Our clients receive the following from our personal tax services in the form of regular email updates :

Download our free Tax Calculator App for calendars, deadlines, advice and other handy tools – everything you need to know about tax and accounts in one place.

Ultimately it comes down to just two words:

WE CARE…

About you, your business, our team, our business, the local community and the environment.

We always strive to do our best, to improve that best and to go the extra mile.

We do what we say we will do. Simple.

Something you should expect from your accountant!

We want you to feel at ease and well looked after – no such thing as a silly question.

We understand how important communication is to you, and will always respond to you quickly.

We take a no-jargon approach and aim to help you understand the numbers that really matter in your business.

Our philosophy is to strive for continuous improvement and empowerment for all.

News relating to Personal Tax

Hands up if you have heard talk of Marriage Allowance? 🙋🏽♀️ Not exactly a reason to say ‘I do’ but definitely a little gem of

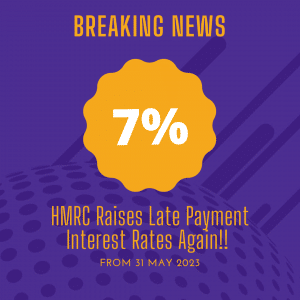

HMRC have just announced that they will raise interest rates on late payments by a further 0.25% from 31 May 2023 to 7%. Repayment rates will also increase to 3.5%

Jeremy Hunt’s first Budget announced on Wednesday 15 March 2023 may have been a bit of a damp squib for small business, but after the chaos of Autumn 2022, for accountants, tax advisors, economists and software companies around the country I suspect there was a huge sigh of relief.

So rather than complain about the lack of anything interesting to talk about, perhaps we should remember that sometimes a little bit of stability goes a long way!

Keep up to date with all the news, events and videos from IN Accountancy

6 Station View,

Rhino Court,

Bramhall Moor Lane,

Hazel Grove,

Stockport,

SK7 5ER

IN-ACCOUNTANCY

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!