The temporary reduced rate of Stamp Duty Land Tax (SDLT) for purchases on residential property and additional properties between 8 July 2020 and 30 June 2021 is fast approaching an end.

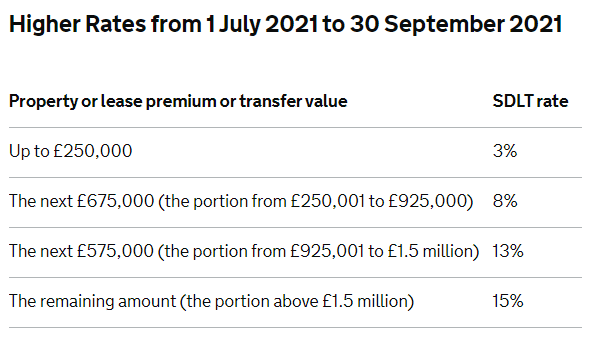

The reductions will be lessened (but still present nonetheless) from 1 July before returning to their standard rates on 1 October 2021.

This article places particular focus on Second-Home owners and those with investment properties.

For detailed information on Residential property SDLT tax rates, please visit the following link: Stamp Duty Land Tax: temporary reduced rates – GOV.UK

What is Stamp Duty Land Tax?

Stamp Duty Land Tax (SDLT) is the tax you pay on the purchase price of any property bought in the UK.

More expensive properties will be required to pay higher rates of SDLT, and the tax is split into bands according to the purchase price of the property.

The nil rate band is usually £125,000. This means that on the first £125k of the property value, no stamp duty is paid.

The next £125k of the property value is then taxed at 2%, then 5% for the next £675k, 10% on any value between £925,001 and £1.5 million, and 12% on anything over £1.5 million.

Why was a temporary reduction in SDLT introduced?

Towards the beginning of the Covid-19 pandemic, the Chancellor Rishi Sunak introduced a temporary reduction in SDLT as one of many initiatives designed to stimulate consumer spending in an effort to keep the economy buoyant and avoid a deep recession.

Did it work?

It certainly did work – the temporary reduction in SDLT was so successful in fact, that the housing market has seen it’s most active period in many years,with house prices in most areas increasing at their highest rate since 2007.

Combined with the Government’s successful furlough scheme ,and the relative inability to spend money elsewhere, with non essential retail and hospitality venues being forced to close, while leisure activities and foreign holidays were banned, may individuals found themselves with more time and more disposable income than ever before.

What happens next?

All good things as they say, must come to an end.

And that end is nigh…the current levels of ‘holiday’ or increase in nil rate band, come to an end at the end of the month.

So if you are thinking of moving house, then you have only 30 days to find a property, exchange and complete to take advantage of the £500k nil rate band before it drops to £250k until the end of September.

As most property acquisitions take a great deal longer than a month to go through, it is already too late for many to start the process.

There is however one area where you can take advantage of your ability to move quickly…

If you already own a second home personally, now may be the time to consider ‘selling’ it to a Limited Company.

The rest of this article examines the changes to SDLT if this is something you are considering. A future article will look at the benefits, and the downside, of holding your investment property in a limited company rather than personally.

Will I receive reduced SDLT rates when purchasing property?

Yes.

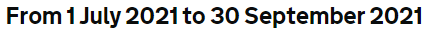

But, this is a temporary rate reduction: The nil rate band will lower from £500,000 to £250,000 on 30 June 2021, then back to £125,000 (the standard amount) on 1 October 2021.

To benefit most from this tax relief, you should take advantage of this ‘holiday’ and move any properties into your Limited Company.

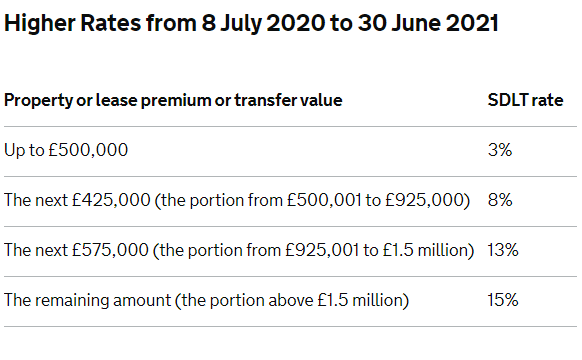

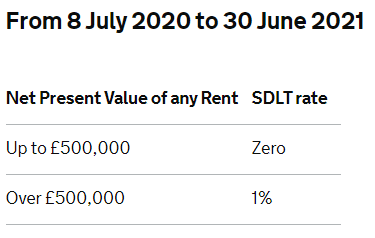

What are the temporary SDLT rates for purchases on Second-Homes and Investment Properties?

For those with second-homes and additional properties and dwellings, the 3% higher rate applies on top of the temporary reduced rates. This is included in the tables below.

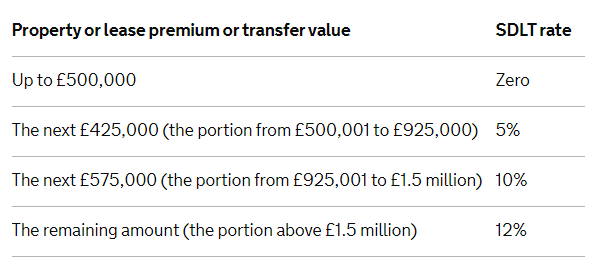

What are the temporary SDLT rates for purchases on Residential Property?

These rates apply to both first time buyers and those had have previously owned property.

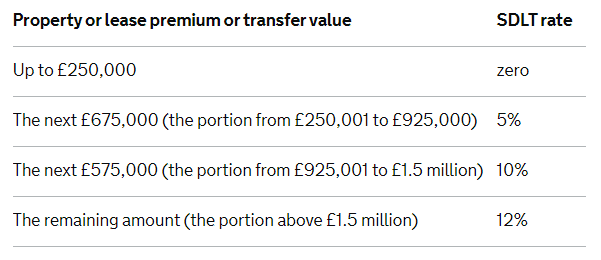

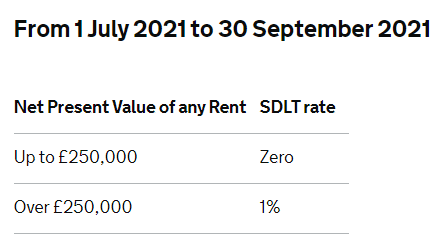

What about the temporary SDLT rates for Rent on Residential Property?

Do companies have to pay a different SDLT rate when buying property?

The normal SDLT rate for companies buying residential property costing more than £500,000 is 15%. There is therefore much to be gained for companies that buy property of any value.

Companies must, however, meet one of the necessary conditions in order to be freed of the 15% rate.

The conditions are as follows.

Property bought by:

- A company acting as a trustee of a settlement

- A property rental business

- Property developers and trader

- Property made available to the public

- Financial institutions acquiring property in the course of lending

- Property occupied by employees

- Farmhouses

- A qualifying housing co-operative

How can I work out how much tax I need to pay?

Use the following Stamp Duty Land Tax Calculator to work out how much tax you will need to pay.

Useful HMRC Resources

Stamp Duty Land Tax: corporate bodies – GOV.UK

What to include in a Stamp Duty Land Tax calculation – GOV.UK

Stamp Duty Land Tax: linked purchases or transfers – GOV.UK

Stamp Duty Land Tax: transactions that don’t need a return – GOV.UK

Stamp Duty Land Tax: shared ownership property – GOV.UK

Still Unsure of Something?

Please contact us here if you have any queries or need some friendly advice – we’d be happy to help.

Alternatively, come and visit us in Hazel Grove for no obligation coffee!