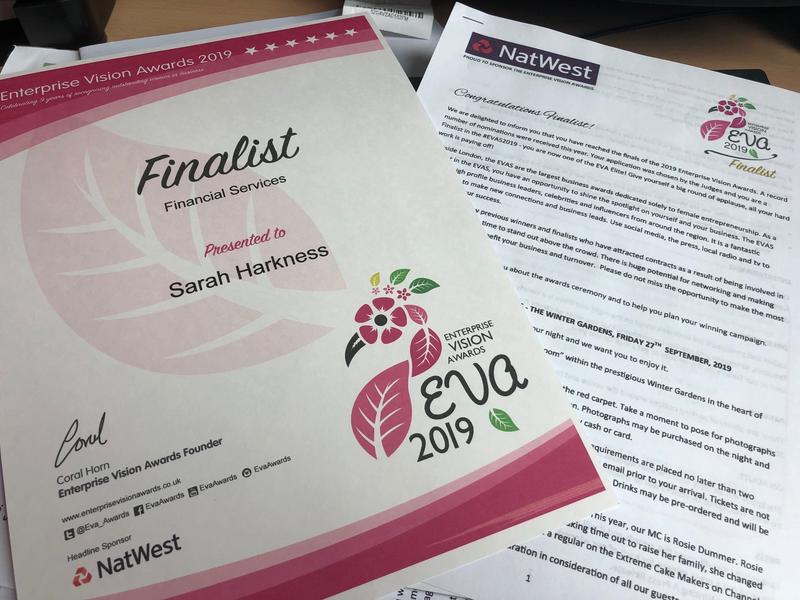

So a few months ago I was absolutely delighted to find out that I had been nominated for an EVA – an Enterprise Vision Awards for women in business. There are 14 categories, and there were more than 10,000 nominations across those categories, so to find out that I was one of eight finalists in the Financial Services category was rather overwhelming.

In July I headed off to the sea side for a very nerve wracking interview – a presentation to panel of three sector experts plus adjudicator then set questions from each of the panel. I have no idea what I said!!

The final phase is the public vote – I have been assured that this only comes into play should the judges fail to come to a unanimous decision (a bit like Strictly really), and that last year the vote only mattered in one category. As usually I have left it until the last minute, but just in case I’m in with a chance and it’s a close call, I’d be incredibly grateful for your support.

Voting closes at midnight tonight – Friday 6th September, and you can do so by clicking the link or button below…

On Friday 27th September, the whole team will be taking a half day and heading to the seaside for a trip up Blackpool Tower before getting our glad rags on for the awards ceremony in none other than the Winter Garden (aka Strictly Come Dancing) Ballroom…. photos will be sure to follow!