It’s exciting times at IN Accountancy as we announce that we are recruiting once again. We’re looking for an outstanding individual to join the IN Team as an outsourced team member.

If you, or someone you know, fits the bill, please ask them to get in touch with me (Sarah) directly). More details below…

IN Accountancy – THE COMPANY

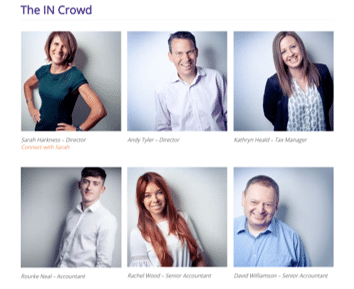

An award winning, Stockport based Accountancy Practice. We focus on looking after growing, owner managed businesses with annual turnover up to around £10m. Established only seven years ago, there are currently twelve of us working together in a modern office. IN is an equal opportunity employer.

The company provides core Accountancy, Tax Compliance & Planning Services to a steadily growing client base of smaller companies and Individuals. Our clients often seek out our knowledge and counsel on their financial affairs, although IN doesn’t offer financial planning we will help on taxation and technical accounting matters.

THE OPPORTUNITY

Our recent growth has created a management opportunity within the company to develop an Outsourced Services Department. The role works closely and directly with the associate accounts director and the rest of the professional services team. You will be working directly with clients small and large as a route to achieving your long-term objectives and career development.

Working with an experienced team of Accountants, you will be responsible for the day to day outsourced finance requirements of a portfolio of IN SME business owner clients. The role will be wide and varied and will require exceptional interpersonal skills, an ability to work independently and to manage multiple priorities and deadlines.

As a forward thinking company who embraces modern technological advancements, you will need to have a good working knowledge of Xero and other cloud based accountancy software, as well as an open mind and willingness to try new things and look for efficiencies, while maintaining the high quality of output which we are known for.

You will be responsible for managing and mentoring junior team members, so a proven track record of developing people will be important.

Key Duties and Responsibilities will Include:

- Sales invoicing and credit control

- Purchase ledger maintenance

- Bank reconciliations

- Accruals and prepayment calculations

- Recording and maintaining a fixed asset register

- Checking, reimbursing and recharging expense claims

THE PERSON

You will be an Accountancy professional able to demonstrate the following:

- AAT Qualified or Qualified By Experience

- Background within a forward thinking Accountancy Practice (c.5 years minimum)

- Commercial, with broad bookkeeping experience

- Client focused approach

- Excellent knowledge of cloud based accountancy packages

- Excellent communication and interpersonal skills.

- Resilience and ability to manage multiple deadlines.

WHAT’S IN IT FOR YOU?

An opportunity to be involved in setting up a whole new department in this fast growing, exciting business. This is more than a bookkeeping job – develop yourself and your future as you help build a bigger and better company.

Naturally we will offer an attractive salary and benefits package for the right individual. Your personal growth and success will be matched by a continuing commitment to recognise your contribution.