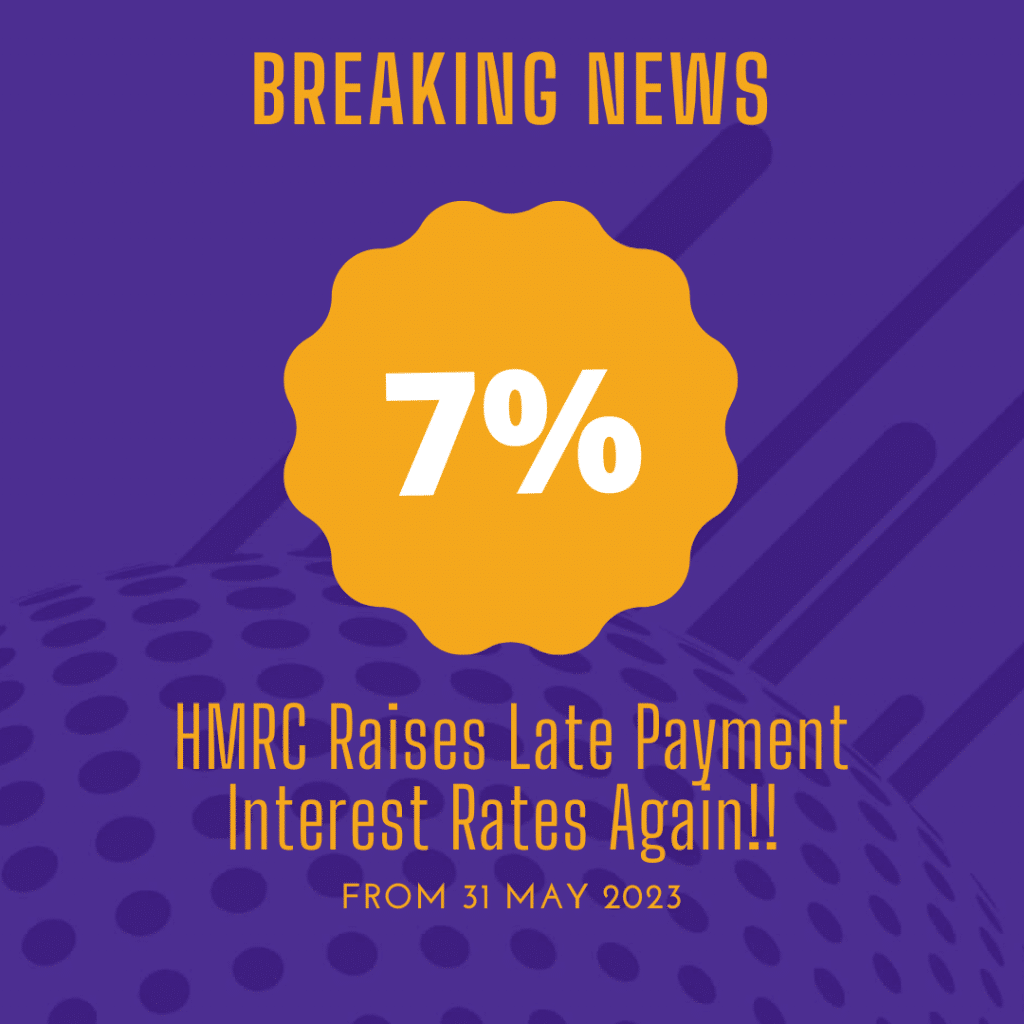

HMRC have just announced that they will raise interest rates on late payments by a further 0.25% from 31 May 2023

This is the latest in a spate of increases since July 2022, and has the late payment interest rate at its highest level since October 2008 (when it was 7.5%) and now double the rate of just one year ago at 7%!

This late payment interest rate applies to any tax bills which are paid late, including Income Tax, National Insurance Contributions, Capital Gains Tax, Stamp Duty Taxes, and Corporation Tax.

What are the HMRC repayment interest rates?

Looking on a slightly more positive side, HMRC have also advised that they will increase the repayment interest rate, also by 0.25%.

This means that HMRC will now pay 3.5% from the same date. This is the highest repayment rate since August 2007 when it was 4% for a brief 6 month period.

Are there any deviations to these rates?

The only difference to late payment charges are to interest charged on underpaid quarterly instalments of Corporation tax payments.

This will change on 22 May and be charged at 5.5% (up from 5.25%).

If you have overpaid your quarterly instalments of corporation tax, or indeed paid early on CT not due by instalment, then the repayment interest will paid at 4.25%!

Please remember also, that just because you complete and file your accounts, corporation tax, or personal tax returns early, this does NOT mean that you have to pay any tax liability at the same time – you can always wait until the deadline before making payment!!

As ever, if you have any questions relating to this, or any of our other articles, please do not hesitate to contact any member of the IN Team who will be happy to help.