Gift Aid Tax Relief for higher rate tax payers – when and how to claim

As we are fast approaching the end of another fiscal year (yep, that time already!), and with Red Nose Day almost upon us, we thought it timely to remind you that if you are a higher rate tax payer you can claim additional tax relief on those Gift Aid donations you make…

If you watched the Kilimanjaro documentary the other evening and did as I did, which was ‘text CLIMB’ to a certain number, then so long as you filled in the right forms and ticked the right boxes, not only does the charity benefit from your basic rate tax relief, but you can offset any higher or additional rate tax against your liability – it’s a WIN- WIN-WIN.

Just remember to make a note of all contributions made during the year to keep things as simple as possible!

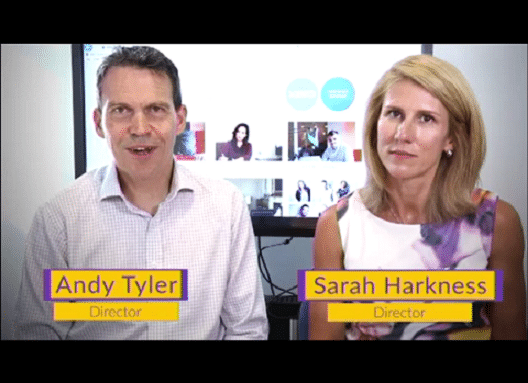

Have a look at the above video for more information on this, or CLICK THIS LINK to access our YouTube channel and see what other videos we have for you.

As always, please CONTACT US if you have any questions relating to gift aid, or other allowable expenses to consider when preparing your information for your 2018-19 tax return.