When did the changes come into effect?

1 April 2021

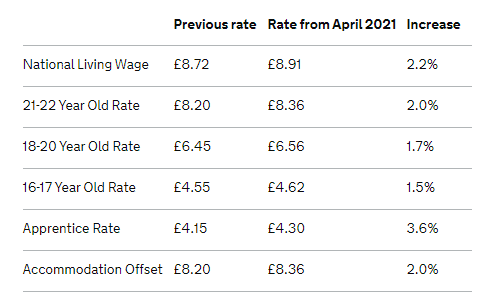

What are the new rates?

What’s changed?

The National Living Wage (NLW) will now apply to employees aged 23 and above! The previous age of eligibility was 25, but the government have reduced it. By 2024, the age of eligibility will be as low as 21.

Am I eligible?

In order to be eligible for National Minimum Wage, you must be at least of school leaving age.

To be eligible for the National Living Wage, you must be aged 23 or over.

What about Apprentices?

To be entitled to the apprentice rate, you must be either:

- Under 19 years of age

- Aged 19 or over and in the first year of your apprenticeship

Apprentices are only entitled to NMW if they are aged 19 or over and have completed the first year of their apprenticeship.

Still not found what you’re looking for?

For all the details on the NLW and NMW, as well as further information about employing staff, please visit the Government’s website at https://www.gov.uk/national-minimum-wage-rates

If you aren’t sure if this applies to you, or if you would like more information, please contact us here. Alternatively, come and visit us in Hazel Grove for a no obligation coffee!