Proposals to change salary sacrifice

Salary sacrifice benefits look set to change as HMRC has announced plans to take away the tax and national insurance contributions (NICs) saving advantages from April 2017.

However, schemes involving pension saving, employer supported childcare and cycle-to-work benefits will not be affected by the proposals.

How does a salary sacrifice scheme work?

Salary sacrifice schemes involve employees agreeing to reduce their Salary in return for non cash benefits, known as benefits in kind (BiKs). Whilst salary is chargeable to income tax and NICs, many BiKs are not. BiKs are therefore used by employers as a useful tool for rewarding their staff.

For instance, if an employer provides a director or employee with a mobile phone for private use, the benefit is exempt from tax and national insurance contributions. So if it is provided in addition to salary there is no extra tax or NICs liability.

It is the same where the employer has provided the phone under a salary sacrifice agreement: both the employer and employee save tax and NICs compared with the employee buying the same phone from their take-home pay.

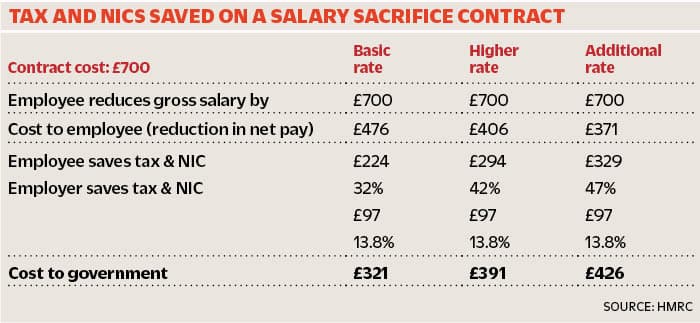

Case study: The £700 telephone contract

The table below shows the amount of tax and NICs saved on a telephone contract of £700 purchased through salary sacrifice by an employee in each income tax band, by an employer, and the overall cost to the Exchequer, according to HMRC.

Reasons for the proposals

There has been a big growth in schemes covering private medical insurance, extra leave, cars, health screening and mobile phones at a time when the Government is seeking to increase tax revenue to reduce its borrowing deficit.

The Government’s strategy is to let employers provide benefits in kind to employees through salary sacrifice but to take away the tax advantages and charge NICs under class 1A on the employer. The closing date for comments is 19 October this year after which the new rules will be announced and will come into force at the start of the next financial year.

If you would like to know you how you can use salary sacrifice to your advantage in the meantime, please don’t hesitate to contact our payroll team payroll@in-accountancy.co.uk or ring Sarah Harkness on 0161 456 9666.