Bounce Back Loan Scheme Goes Live and More on SEISS

As the Coronavirus Business Bounce Back Loan Scheme went live today, and HMRC updated it’s information and guidance regarding the Self Employment Income Support Scheme

As the Coronavirus Business Bounce Back Loan Scheme went live today, and HMRC updated it’s information and guidance regarding the Self Employment Income Support Scheme

The Coronavirus Business Bounce Back Loan has been introduced to support small and medium sized businesses suffering due to the current COVID-19 Coronavirus crisis. Here

Updated Wed 15 April with new news relating to SBG, CVJRS and SEISS including How to Claim, Who can Claim, and What information you need

Businesses that have been affected by the COVID-19 pandemic and are seeking to make use of the VAT deferral have been urged to cancel their direct debits ‘as soon as they can’.

Top Tips for surviving challenging times, alongside technical update relating support available forUK small business during COVID-19 Coronavirus Crisis

On 26 March, Chancellor Rishi Sunak announced a scheme to help self-employed workers who have been hit by the COVID-19 crisis.

On 17 March, Chancellor Rishi Sunak unveiled a £330 billion package of support for the UK economy as it combats the COVID-19 pandemic.

IN Accountancy client communication on the morning of 31 March 2020 with further updates about new details regarding support available for businesses through the ongoing

Self-employment Income Support Scheme (SEISS) – what we know at this moment in time. Communication to IN Accountancy clients March 26 2020 in relation to

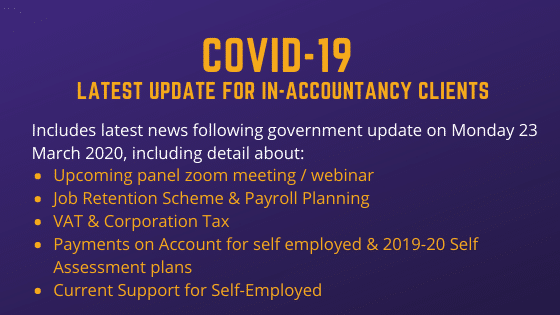

Just posting full text of the communication we sent to all clients on Monday evening in case anyone else finds it useful. Please feel free

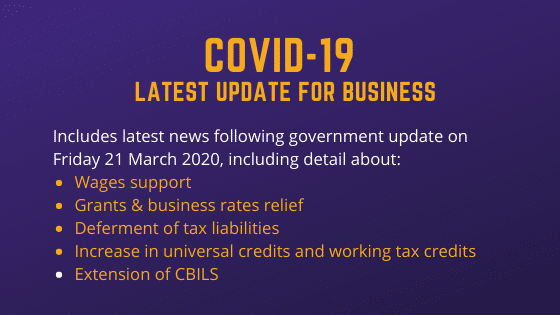

Following last night’s announcements about increased support for businesses, employers and self employed please find below a summary of what is in place as well

Stockport Council outline support for business amid Coronavirus outbreak Stockport Council understands that this is a very difficult and uncertain time for business and is

Keep up to date with all the news, events and videos from IN Accountancy

6 Station View,

Rhino Court,

Bramhall Moor Lane,

Hazel Grove,

Stockport,

SK7 5ER

IN-ACCOUNTANCY

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!