Merry Christmas from everyone at IN Accountancy ❄????????????❄

It’s Christmas!! Well nearly! ???????? We have a very special guest in the office today – Scoobie, Olivia’s absolutely gorgeous Labrador puppy, although at six

It’s Christmas!! Well nearly! ???????? We have a very special guest in the office today – Scoobie, Olivia’s absolutely gorgeous Labrador puppy, although at six

We were recently approached by The Fermenter’s Guild to write an article for their members on the top things to consider when setting up or

Yesterday was a day which many of us have been looking forward to for a very long time: April 12th 2021… the day ‘non essential’

Are you ready to kick-start your career in Digital Content Marketing? Award winning IN-Accountancy is looking for a Digital Content Marketing Apprentice to join their

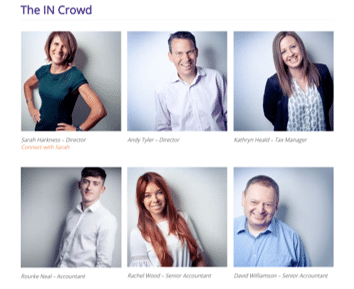

It’s exciting times at IN Accountancy as we announce that we are recruiting once again. We’re looking for an outstanding individual to join the IN

New company car advisory fuel rates have been published and took effect from 1 December 2020. The guidance states: ‘You can use the previous rates for

HMRC is warning self-assessment taxpayers to be alert to the danger of scammers posing as the tax authority in the lead up to the tax

It’s exciting times at IN Accountancy as we announce that we are recruiting once again. We’re looking for an outstanding individual to join the IN

In a new consultation HMRC has confirmed that Making Tax Digital for corporation tax (MTD for CT) will not be implemented until 2026 ‘at the

In these crazy times I would normally be thinking about the start of September as a time, almost like the start of January, to really

It’s been a while since I’ve written. so I thought it might be time to remind you about a couple of things… Flexible Furloughing starts

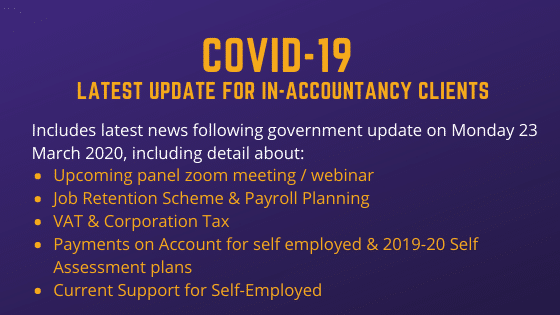

Just posting full text of the communication we sent to all clients on Monday evening in case anyone else finds it useful. Please feel free

Keep up to date with all the news, events and videos from IN Accountancy

2 Station View,

Rhino Court,

Bramhall Moor Lane,

Hazel Grove,

Stockport,

SK7 5ER

IN-ACCOUNTANCY

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!