It’s been another week of wins for the IN Team…

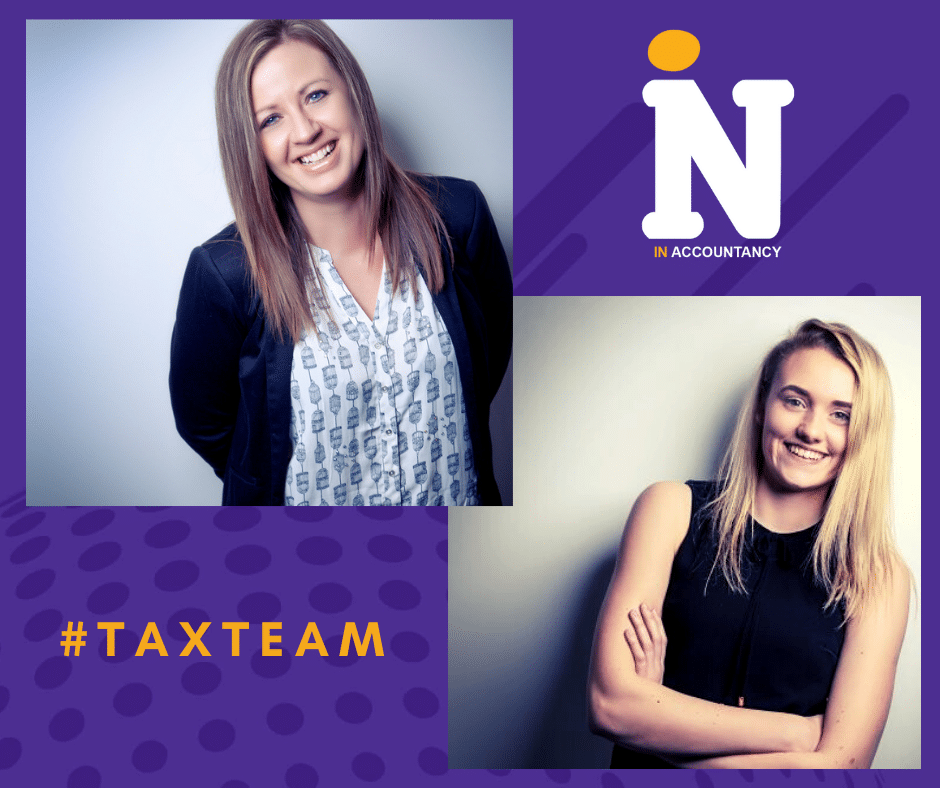

After last week’s update about Rourke’s successful qualification as a fully fledged Level 4 AAT, we have more successes to share, as both Kathryn and Olivia received exam results today.

Kathryn passed the notoriously difficult CTA (Chartered Tax Association) ‘Taxation of Owner Managed Businesses’ exam with flying colours, while at the same time Olivia passed her ATT (Association of Tax Technicians) Business Tax exam with equally flying colours.

They have both worked so hard to complete these exams during a challenging period for all accountants, and tax specialists even more so, and we couldn’t be more proud of them.

I am sure you will join me in extending your congratulations to them both ????????????

For more about the IN Team visit our website here, and do drop us a line or give us a call if we can be of any assistance with regards to your Tax or Accounting needs