How to Change Accountants… it’s easier than you think

I’ve been asked half a dozen times recently how to change accountants, with local businesses being put off moving away from poor service, mistakes or

I’ve been asked half a dozen times recently how to change accountants, with local businesses being put off moving away from poor service, mistakes or

Those of you who have popped into the office or given us a call in the last couple of months may have noticed some new

The Autumn Budget 2018 announced that changes to off payroll working in the private sector would not be introduced before 2019/20 tax year, and even

The changes introduced in the 2018 Autumn Budget mean that many contractors could be almost £1,000 better off under the new tax rules. We have

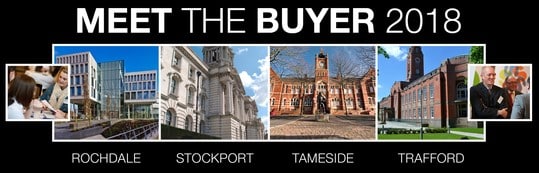

Meet the Buyer is returning in 2018 on Thursday 22nd November! The popular event gives Stockport suppliers the opportunity to promote their goods and services

But do make sure you pay on time Here’s how… STEP 1: Find your UTR Find the letter from HMRC requesting you complete a self

Working from Home? Your guide to what you can and can’t claim in terms of tax relief… There are a number of opportunities to obtain

Business mileage and tax relief explained What is business mileage? How is it worked out and how do we claim tax relief on the miles

How to change accountants – it’s easier than you think! The reason most often given to us as to why individuals and businesses stay with unsatisfactory

IN Accountancy, Stockport are absolutely thrilled to have once again been shortlisted for a Talk of Manchester TOMs award – this year for the BEST BOUTIQUE

If you are over 55 and have accessed any of your pension this affects you, so read on… In Philip Hammond’s 2016 Autumn statement he

New for 2017/18 – The updated and enhanced IN Accountancy TaxApp

Keep up to date with all the news, events and videos from IN Accountancy

6 Station View,

Rhino Court,

Bramhall Moor Lane,

Hazel Grove,

Stockport,

SK7 5ER

IN-ACCOUNTANCY

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!